- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

Welcome to the third article in our new Commodities Analyzed series! In this series, we take a deeper look at data and analysis from Supplyframe Commodity IQ’s recent mid-quarter 2023 summary, offering a look at what users can expect and learn from the information available to them.

In this final part, we look at DRAM, SRAM, and specialty components, offering a combination of real-world data, deep expert analysis, and a better understanding of how key metrics like lead times, pricing, and availability will shift for this commodity in 2023.

Electronics Memory Commodities: Description & Overview

Supplyframe Commodity IQ (CIQ) tracks and forecasts market dynamics, pricing and lead time for the three major categories of electronics memory: Dynamic Random Access Memory (DRAM), Static Random Access Memory (SRAM), and specialty components including Programmable Read-Only Memory (PROM), Erasable Programmable Read-Only Memory (EPROM) and Electrically Erasable Programmable Read-Only Memory (EEPROM). CIQ also forecasts leading indicators including component design and demand, and production volumes.

South Korea’s Samsung Electronics and SK Hynix dominate the memory sector, controlling about two thirds of the world’s memory market. Japan-based Kioxia and US-based Micron account for about 20% and 11% percent, respectively. China’s YMTC, produces flash memory chips used in storage, and is China’s largest memory chip maker, responsible for about 6% of global memory output, according to market tracker TrendForce.

Demand and supply of memory chips is primarily driven by the pace of economic growth. According to the IMF, annual global GDP growth is projected to fall from 3.4% in 2022 to 2.9% in 2023, then inch back up to 3.1% in 2024. The latest forecast for 2023 is 0.2% higher than predicted in the October 2022 World Economic Outlook but below the 23 year average of 3.8%, from 2000 to 2022.

Rising interest rates and Russia’s war on Ukraine are contributing to the downward pressure on growth in the memory market. As growth slows, inflation is expected to moderate. The IMF expects global inflation to drop from 8.8% in 2022 to 6.6% in 2023 and 4.3% in 2024, which is still above pre-pandemic levels of about 3.5% from 2017 to 2019.

Our Point of View

In May 2022, Supplyframe Commodity IQ (CIQ) identified a slowdown in engineering design demand for consumer electronics, PCs and smartphones which led to a slowdown in market demand. The downturn has continued into 2023 and is expanding to include cloud storage hyperscalers, and enterprise computing and storage companies.

Based on market insights, CIQ predictive intelligence is forecasting a downturn in DRAM demand starting in Q2 2023 and continuing through the second half of 2023. As consumer demand wanes, memory chips, especially DRAM, are the leading indicator for other semiconductor categories. In 2021, DRAM annual revenue growth skyrocketed to 40%, and in 2022, it declined by about 13%. As a consequence, major DRAM companies, including Micron, Samsung and SK Hynix, are now reporting significant reductions in CAPEX spending in an attempt to bring supply and demand back into equilibrium.

Micron’s latest Q1 2023 report had revenue falling 46.8% to $4.09 billion as DRAM and NAND prices plunge, according to Seeking Alpha. The company’s Q2 2023 memory revenue guidance projects a further drop to $3.8 billion as buyers slow purchasing and work down current inventory. In addition, Micron announced in December 2022, it would cut its budget for new plants and equipment in addition to reducing output.

In the past, market leader Samsung has typically continued to spend during downturns, hoping to exit with more production and higher profitability when demand picks up. However, this time around, the market believes Samsung will tighten chip supply. One benefit is a higher stock price in Q1 2023.

How Supplyframe Analyzes DRAM, SRAM and Specialty Memory

On a quarterly basis, Supplyframe Commodity IQ (CIQ) tracks and forecasts market dynamics, prices and lead times of all memory components. CIQ also forecasts component design and demand and production volumes. For example, CIQ monitors DRAM spot prices, which declined in January 2023. Prices for 8Gb DDR4 DRAM dropped by 7% in January, following a 4% to 5% decline in December.

Here are four data points CIQ captured and analyzed that inform the quarterly forecasts.

- CIQ is projecting the 2023 global semiconductor market will decline by 4.1%, to $557 billion, driven by the memory segment. In the latest forecast, memory is projected to fall to $112 billion in 2023, a 17% drop compared the 2022. Other major categories are expected to post single digit growth including analog, discrete, optoelectronics and sensors.

- DRAM and NAND have been in a state of oversupply that CIQ projects will last through 2023. Prices are expected to continue to decline and memory suppliers are expected to cut back production to bring supply and demand into balance.

- DRAM ASPs, consisting of a blended average of DDR3, DDR4, and mobile DRAM pricing, have declined by about 15% to 20% and are projected to continue shrinking into the second half of 2023.

- Blended ASPs for DRAM, DDR3, DDR4, and mobile DRAM declined by 15% to 20% quarter-on-quarter in Q4 2022. CIQ projects ASPs will continue to shrink through the year.

Top Priority Industry Segments

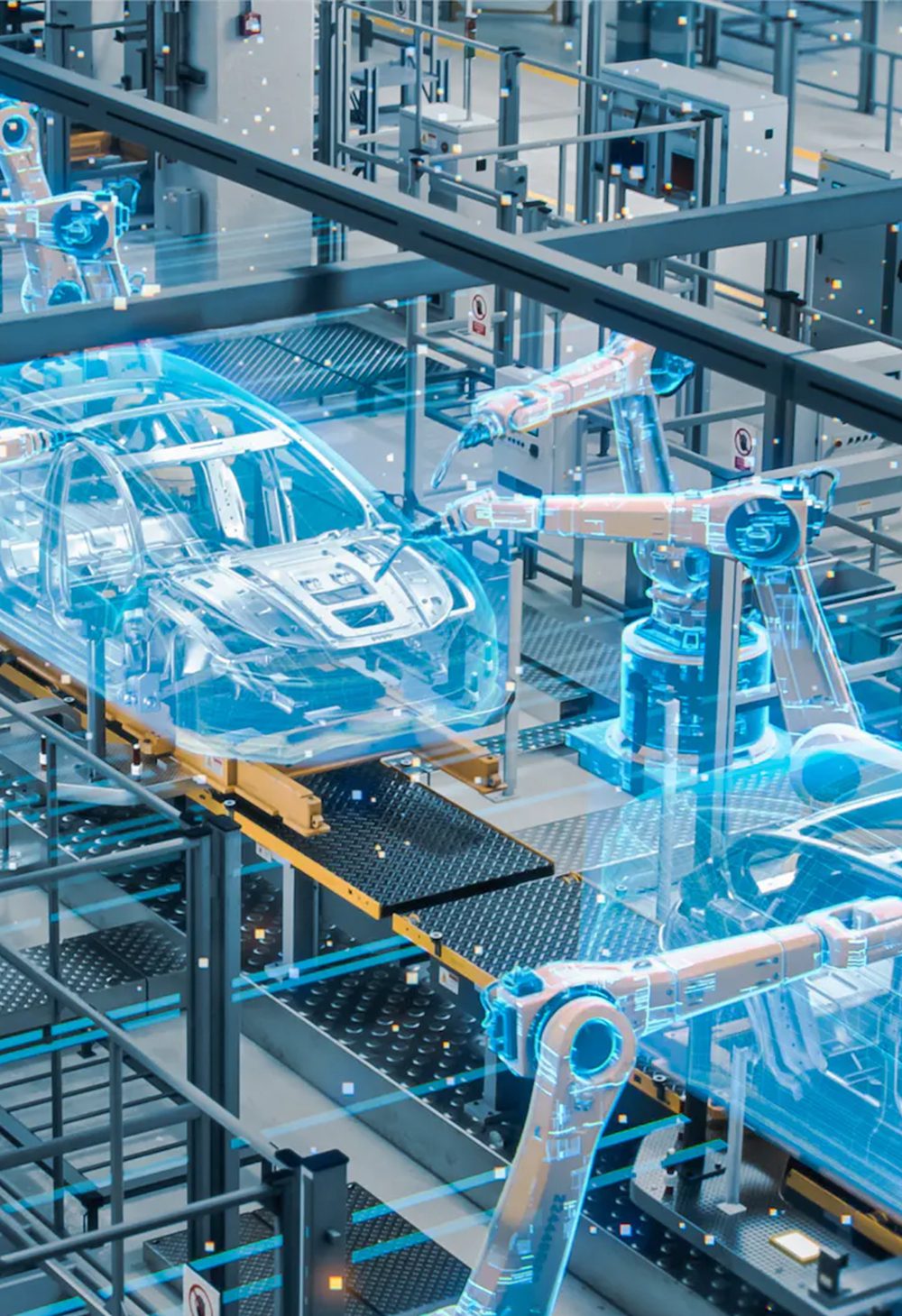

All industry sectors, from automotive, mobile phones, gaming consoles, household appliance, textile mills to artificial intelligence, industrial production, cloud, edge, quantum computing, supercomputers, are dependent on memory components. Here we look at market conditions for three prominent sectors.

Automotive

Automotive DRAM demand increased by about 50% year-on-year through 2022, and is projected to increase by over 55% in 2023. The rapid growth in auto DRAM is required for autonomous driving applications, vehicle-to-vehicle mobile communications, driver and passenger graphic displays, to name a few. The longer-term automotive memory growth forecast is for 20% revenue growth by 2027, according to the Yole Group. Demand and supply of SRAM is expected to remain stable throughout the first half of 2023.

Servers and data centers

In the first quarter of 2023, global server shipments are set to decline by 10% on both a sequential and year-over-year basis, according to one market researcher. The contraction is being spurred by challenging economic conditions, specifically slowing demand from U.S. server OEMs and Chinese data centers. On the bright side, Supplyframe CIQ forecasts DRAM demand by hyperscale data centers, which have large data processing and storage requirements, will increase as demand ramps.

Server applications are integrating artificial intelligence and high-performance computing (HPC) which demand a lot of memory. TrendForce forecasts the DRAM content of these servers will increase by 12% to become the largest DRAM customer in 2023 and potentially over the next several years. DRAM suppliers will keep growing the share of server memory in their portfolio this year to about 38% of the bit output, compared to about 37% for mobile DRAM.

Commodity IQ Forecast for The Memory Market

Supplyframe CIQ forecasts the memory market is set to contract in the second half of 2023. The exception is DRAM, which CIQ predicts will recover in H2 as hyperscale demand is rejuvenated and electrification ramps. The automotive memory demand is projected to bounce back in the next few years, posting memory revenue growth of 20% by 2027.

Stable demand and supply conditions are prevalent in the SRAM marketplace. This balanced state is expected to continue throughout the first half of 2023.