- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

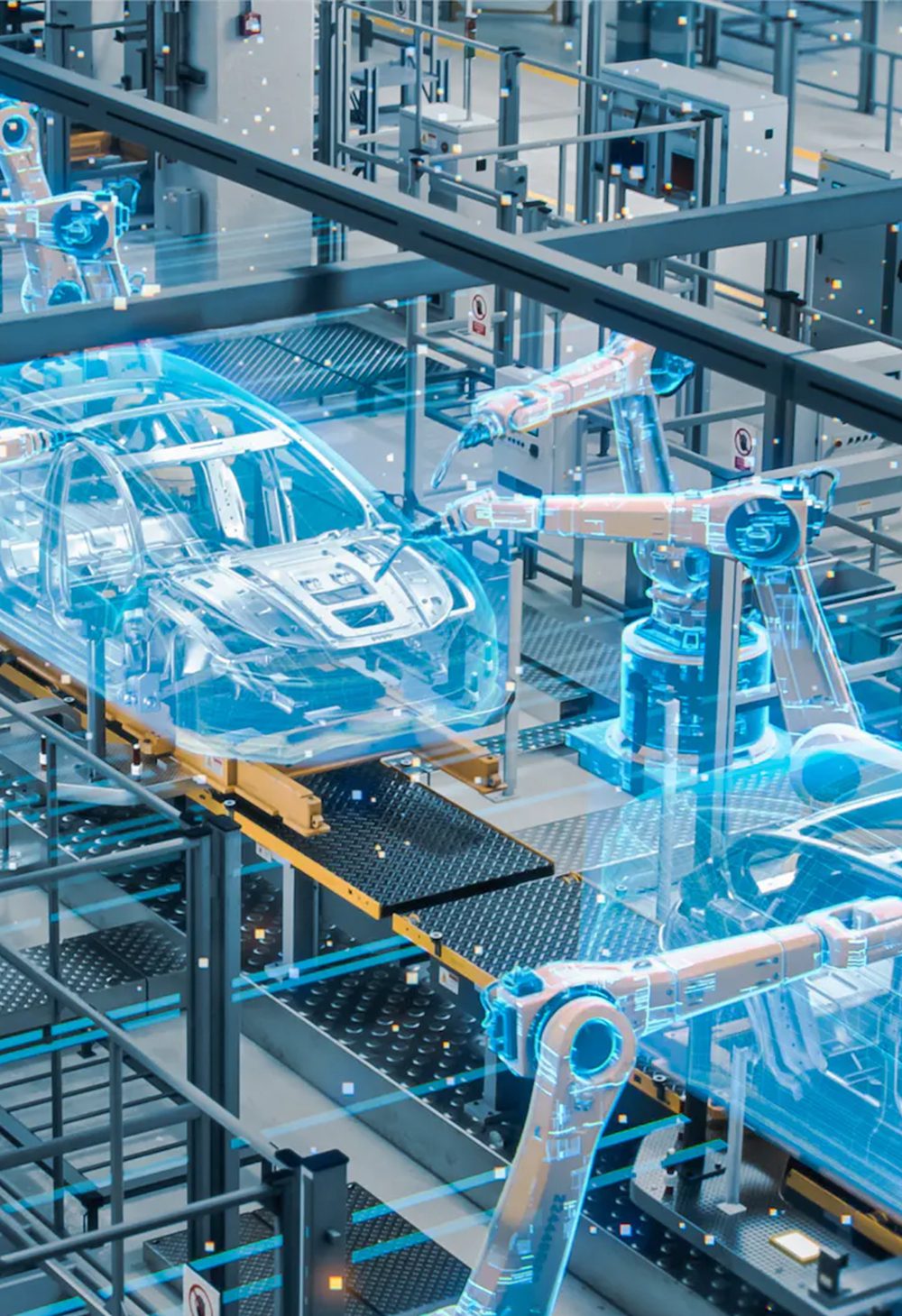

Shortages and constrained supply are nothing new for electronics supply chains, but for automotive leaders, a series of events from 2020, product planning challenges, multi-tier supply chain dynamics, and geopolitical factors have combined to create what many call a “perfect storm” – one that leaves us deep in a global semiconductor shortage well into the second half of 2022.

What’s the full scope here, and what can we learn for the future? After all, vehicles are becoming more complex, and with the onset of self-driving cars, that complexity is only going to increase the demand for semiconductor content and key electronics components in new vehicle designs. Join us as we take a journey through the past, the present, and the future of automotive electronics, and how the industry will need to change to prevent or mitigate shortages.

The Past: 1970 – 2019

The roots of the current situation date all the way back to 1970, with the introduction of “Just-in-Time” (JIT) Manufacturing. What originally began as a management philosophy that focused on producing exactly what demand requires, but has shifted towards minimizing waste in manufacturing.

The philosophy was developed and perfected in Toyota’s manufacturing plants in Japan, and it has become the main approach for the automotive industry as a whole over the decades. The problem with this approach, of course, is that it depends on a constant and reliable source of supply.

The influence that the automotive industry has over the typical parts in their supply chain allowed them to carry on like this for decades, carrying very little inventory and focused on continued cost efficiencies. However, new challenges emerged when this supply chain model extended into more dynamic electronic commodities and standard ICs, which has a much wider customer-base that includes consumer electronics giants and smartphone manufacturers.

Parallel industries such as communications and the 5G value chain exert an critical indirect impact on both continuity of supply and cost drivers for these common commodities. It is worth understanding how recent shifts in geopolitical tensions and trade agreements has been a recent source of uncertainty and disruption.

Namely, the ongoing shift in retaliatory tariffs between the US and China and specific restrictions on trade with specific companies such as Huawei during the Trump Administration. This situation remains unsettled as the new Biden administration has taken office.

As the sanctions loomed, Huawei stockpiled critical radio chips to ensure they could supply Chinese carriers with their rollout of 5G technology into 2021. They partnered with Taiwan Semiconductor Manufacturing Co. to ramp up output in late 2019, specifically targeting their 7-nanometer Tiangang communication chips that are used in 5G base stations.

When combined with other trade sanctions in the fourth quarter of 2020, other customers of China’s leading chip maker, Semiconductor Manufacturing International Corporation (SMIC) were also forced to place large orders with their alternate suppliers, thus draining the available supply.

In addition to these shifting trade policies and their ripple effects, major unpredictable risk events have continued to cause production delays or interruptions in the automotive value chain. We have just recently observed the 10 year anniversary of “3-11” as it is known in Japan, of the major 9.0 earthquate off the coast Sendai and the related tsunami and nuclear power plant disaster that had far reaching impacts on single sources of supply for Toyota and other automotive OEMs.

In 2016, another major earthquake in the south of Japan also resulted in shutdowns across Toyota’s assembly lines, further showcasing the vulnerabilities that a JIT approach presents in the face of disasters.

This brings us to 2020, the year the world was hit by a global pandemic.

The Present: 2020 – 2022

There has been much discussion around the drastic shifts in demand as a result of COVID-19. A rise in consumer electronics came from new smartphones, new video game consoles, and the surge of demand for those that needed tech to work from home.

Meanwhile, automotive demand dipped as people bought less cars during the worst months of the pandemic. What no one expected, however, was the shift in Q4 that brought back that demand unexpectedly.

We covered the intricacies of this “perfect storm” in a prior article, which also includes Supplyframe’s own unique perspective through the lens of our Design-to-Source Intelligence (DSI) Network. The article also includes actionable takeaways from Supplyframe CMO, Richard Barnett, who shares his own advice for automotive manufacturers in this shortage season.

We also recently spoke with Mike Hogan, the Senior Vice President and General Manager of the Automotive, Industrial & Multi-market at GlobalFoundries, who shared his own insights in another recent article. In this piece, we examined the modern process of semiconductor manufacturing, and the challenges associated with trying to scale such an expensive and specialized process.

Hogan also shared some additional perspective on the current shortages, pointing to the fact that stable demand over time made the automotive industry’s “just-in-time” approach easily workable. Given the current shortages, Hogan reminds us that the system hasn’t been tuned to the semiconductor supply market volatility and lead time considerations for over forty years.

The root of the issue, as Hogan puts it, is not a problem of aggregate capacity, but capacity across numerous technology nodes that were spoken for by other industries like consumer electronics. Automotive OEMs purchase multiple electronics from tier 1 suppliers, who purchase from a variety of vendors. Those vendors may or may not manufacture their own silicon wafers, but in the end, the foundry doesn’t have any visibility into where the chips are going.

Furthermore, the OEMs themselves serve multiple purposes and go to multiple tier 1 suppliers, so not even they can accurately say which chips should be given a higher focus. Hogan also mentioned that two major things have changed over time for automotive manufacturers:

- The differentiator in modern automobiles is sitting upon semiconductor technology. The entire user experience revolves around these types of chips. As he puts it, “it’s not just about power windows anymore”.

- The industry as a whole doesn’t have a handle on the full supply chain or a keen understanding of which technologies they were relying on. Until recently, supply lead times were relatively stable, but the COVID-19 pandemic dramatically shifted demand and supply and exposed gaps in both visibility and understanding. Hogan summarizes this by saying “everyone wanted more, but couldn’t articulate what that is,” in regards to the specific technology nodes they required.

Hogan goes on to describe the digital economy as an inverted pyramid. Everyone is more reliant on the next step down, from electronics to semiconductors to foundries. When you reach the bottom, there are only a handful of players in the supply base who can manufacture the semiconductors needed across Automotive and other electronics industries.

With utilization correct until this point, no one could see the issues with this structure. Liability also gets pushed down the pyramid, often to key Tier 1 and semiconductor suppliers, with automotive manufacturers under the assumption that a percentage of capacity was reserved for them, which was not the case.

Hogan advises automotive manufacturers to act more like smartphone makers in the sense that those manufacturers know where their supply goes, where it comes from, and have their supply chains mapped accordingly.

This is just the first step, however. Let’s look to the future, beyond the immediate shortages.

Preparing For the Future

While this shortage is the result of some immediate factors, other trends will continue to place pressure on all tiers of automotive manufacturing as time goes on. Statistics show that automotive electronics will account for 50% of the total vehicle cost by 2030, which is a 15% increase from 2010.

This is in line with the rise of autonomous vehicles and the complex electronics present throughout their designs. In our discussion with Hogan, he placed the responsibility on automotive manufacturers to drive the supply chains forward. Specifically, OEMs can take advantage of this opportunity to paint a brighter picture for the future.

Hogan points to Tesla as an example. They design their own chips and architectures, starting from scratch. This creates two distinct benefits: a connection to the supply itself, and no need to share it with other competitors or industries.

When we consider things like MCUs, OEMs are buying off-the-shelf technology that carries a risk of being used elsewhere. The cost is lower, thanks to the overall volume, but there’s a dangerous assumption here that the supply can be shared between all of the demand.

Hogan advises automotive OEMs and Tier 1 suppliers to rethink their product design and platform strategies. They can change the architecture to give themselves more control. When it comes to self-driving vehicles, GM doesn’t want to buy the same radar chip as Ford or Chrysler. These competitors are fighting over the same technology, while someone like Tesla made their own.

Hogan predicts a new normal, saying that the only thing we can be certain of is that broad change is required and inevitable. Foundries are already seeing some OEMs and Tier 1 suppliers greater vertical integration and specific commits to make their own silicon, a key strategy to improve resiliency and control when elements of the supply chain are vulnerable.

Given the intolerance of semiconductors to rapid scalability, Hogan offers an optimistic look at the future, saying that things will work out, but future leaders will seek design in greater resiliency and flexibility from platform design to supply chain coordination, whereas older ones will take longer to adjust, given the rigid nature of their supply chains.